Marketers love metrics. And customer lifetime value (CLV) is one of the most important measures you can track.

Calculating CLV can yield useful insights into your customers’ behavior, and when used alongside other data, like the cost of acquisition (CAC), it can help you make marketing decisions that lead toward greater profitability. Once you know the CLV of different customer segments, you can pinpoint which segments carry the most value and adjust your marketing to maximize results for those groups.

The best news? You can calculate CLV with a simple formula.

What Is Customer Lifetime Value?

Customer lifetime value (CLV) is the total amount of revenue a business can expect to earn from a customer over the entire period they remain a customer. It is also sometimes abbreviated as CLTV or just LTV.

Several benefits make calculating customer lifetime value a good move for marketers.

Why Is Customer Lifetime Value Important?

In acquiring the data you need to calculate CLV, you will come to better understand the behavior of your customers, leading to new ideas for upsells or increased purchase frequency. When CLV is tracked alongside other metrics, you will achieve even greater insights:

- How long it takes before the customer relationship becomes profitable (at what point the revenue you earn from them is greater than the cost you invested in gaining them as a customer)

- When the cost of maintaining the customer outweighs its value

- Which personas or segments are most profitable

With this information, you can:

- Project revenue for business planning

- Plan how much to spend to acquire customers

- Spot opportunities to increase customer lifetime value over time

You can also gain a more accurate sense of the value to assign to your conversion metrics. For example, you’ll know what it’s really worth to secure a lead with your online advertising programs. This can help you evaluate your marketing spend.

Perhaps best of all, you don’t need a team of data analysts to help you calculate it. With just a simple formula, you can get a basic understanding of the lifetime value of your customers.

How to Calculate Customer Lifetime Value (CLV)

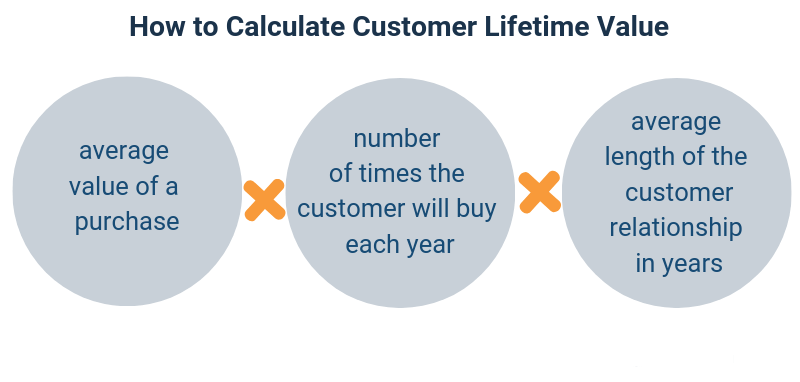

There are many ways to calculate CLV. If you are new to this metric, one way to start is with this basic CLV formula:

CLV = (average value of a purchase) X (number of times the customer will buy each year) X (average length of the customer relationship in years)

Each of the inputs for the formula above requires calculation, too. Here’s how you can figure those out.

Average value of a purchase

You can find the average amount that your customers spend every time they buy by dividing your annual revenue by the number of purchases that were made during the year.

annual revenue / number of purchases

Number of times the customer will buy each year

The frequency of purchases can be computed by dividing the number of purchases per year by the number of customers who bought from you.

total number of purchase transactions per year / total number of customers who bought from you

Average length of the customer relationship in years

If your business operates on contracts, you can calculate the average length of your contracts to get this figure. If you operate a subscription-based model, divide 1 by the rate at which you lose customers, called your churn rate.

Should you subtract the cost of acquisition (CAC)?

Some businesses choose to include the cost of acquiring customers in their calculation of customer lifetime value. Neil Bendle, an assistant professor of marketing at Western University’s Ivey Business School, recommends keeping the metrics separate. His rationale is that CLV is intended to be a forward-looking measure, while acquisition costs are past measures. He points out that it may provide a distorted view of the value of different customers.

Experts recommend keeping acquisition costs separate from your CLV calculations

Acquisition cost is certainly important to consider, but you can compare it after you’ve gone through the basic calculation for CLV.

Customer Lifetime Value Examples

Not all companies will factor information the same way for each input needed, so let’s walk through the calculation for two different business models.

Calculating CLV for an SEO agency

Many SEO agencies operate on a monthly billing system. The client pays a base cost per month for their plan, and they may add on costs for additional services as needed. Let’s assume that the average amount billed monthly is $2,000 per client. The average length of a customer relationship could vary widely from one firm to another, though the average agency relationship is thought to be less than three years. Let’s use two years in this illustration.

Average value of a purchase = $15,000

Number of times the customer will buy each year = 12

Average length of the customer relationship in years = 2

CLV = $2,000 x 12 x 2 = $48,000

This shows that the average customer at your SEO agency is worth $48,000 to your firm over their lifetime.

Calculating CLV for an online retail store

Many retailers rely on a large set of customers for relatively small transactions. Your customers may buy every day if you’re a coffee shop or once every few years if you sell furniture, for example. Let’s consider what this might look like for an online clothing retailer.

We’ll use the following industry average data, but you will need to use your own data to get a meaningful picture for your business. Your store management software may contain much of the data you need.

Average value of a purchase = $104 (source)

Number of times the customer will buy each year = 3.58 (source)

Average length of the customer relationship in years = 3 (source)

CLV = $104 x 3.58 x 3 = $1,116.96

The average fashion retail customer lifetime value is $1,116.96, using the figures above.

Limitations of a Simple CLV Formula

While this simple formula is convenient, it is limited.

The simple method of calculating customer lifetime value does not consider factors that change over time. This may include the loyalty rate of your customers and any changes in your pricing. It also ignores the time value of money, stating figures in current terms that will differ in future value.

You will also find that different segments of customers will hold different value. If you calculate CLV separately for different segments of customers, it can provide a powerful view of the value that your personas contribute, for example. (You can learn more about the value of segmenting here.)

How to Improve CLV for Your Business

The longer a customer continues to buy from you, the greater their value to your business. Thus, you can improve customer lifetime value by improving retention and reducing churn rate:

- Prioritize great service after the sale.

- Make transactions easy and smooth.

- Develop a brand personality that helps buyers identify with you on a personal level.

- Align with a cause that is meaningful to your buyers.

- Offer rewards for future purchases.

- Add an upsell strategy.

- Provide something that no other operators in your space can provide.

Consider if any of these might make sense to include in your marketing strategy. Then take stock of how your CLV improves.

Calculate CLV, Then Adjust It

CLV deserves a place alongside the other goals and marketing metrics you measure. It can provide insights that will improve decision-making and help you drive your business toward profitability.

Related: What are marketing KPIs?

There are various approaches to calculating customer lifetime value. As your business grows and becomes more complex, you may want to explore the inputs in the formula more deeply and segment your customers into groups, each with their own calculation. For now, this simple formula can set you on your way to a better understanding of the value of your customers to help inform your marketing decisions.